CGT Reprieve?

Thursday 14th November 2024

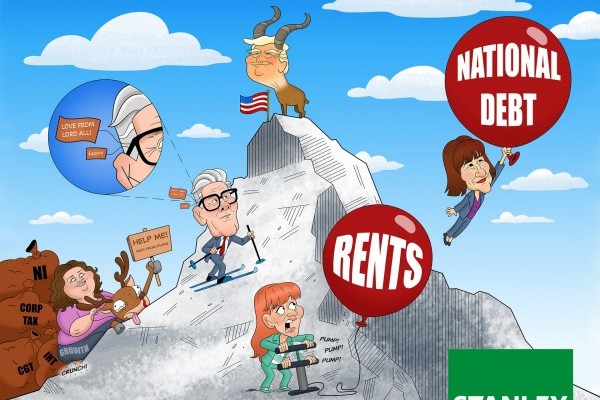

The London property market heaved a sigh of relief when the Chancellor did not raise CGT to align it with Income Tax in the budget.

Whilst The Labour Party did not admit to any tax rises in the run up to the election, it was heavily trailed before and after it, that there was an ‘aspiration’ to raise CGT generally to Income Tax levels.

10 days or so before the long-awaited budget, the Treasury, in leaks to the press, sat on the idea saying they were not, after all, going to raise CGT on residential property, leaving it at 24%.

It seems they had actually listened to those with more understanding of the real world than themselves.

In the end Rachel Reeves confined herself to raising CGT on other asset classes to 24%, matching property rates.

I applaud having CGT rates the same across all asset classes. To do otherwise distorts investment decisions.

It is now possible to argue there is less point selling residential property to invest elsewhere because other asset classes will be taxed at the same rate.

The Chancellor has stated that these were ‘one off’ emergency tax rises and she will not raise taxes again in future budgets.

However….

...the budget generally showed an incredible lack of understanding how business functions, and how to raise the tax take through growth.

It strikes me as highly likely that our Rachel will be back with more ill-advised tax rises in the not-too-distant future. Like a ticking tax time-bomb.

I further suspect CGT on residential property will be one of the first to be raised further.

After all, The Treasury can, quite justifiably say at the next Budget, they are simply putting it back up to the 28% level at which the Tories had it.

Then at the Budget after that, align it with Income Tax?

We will see.

Do let me know your thoughts.

Until next time……

PB

Share this article

k L E D