As interest rates rise, the rental investor still wins

Sunday 20th February 2022

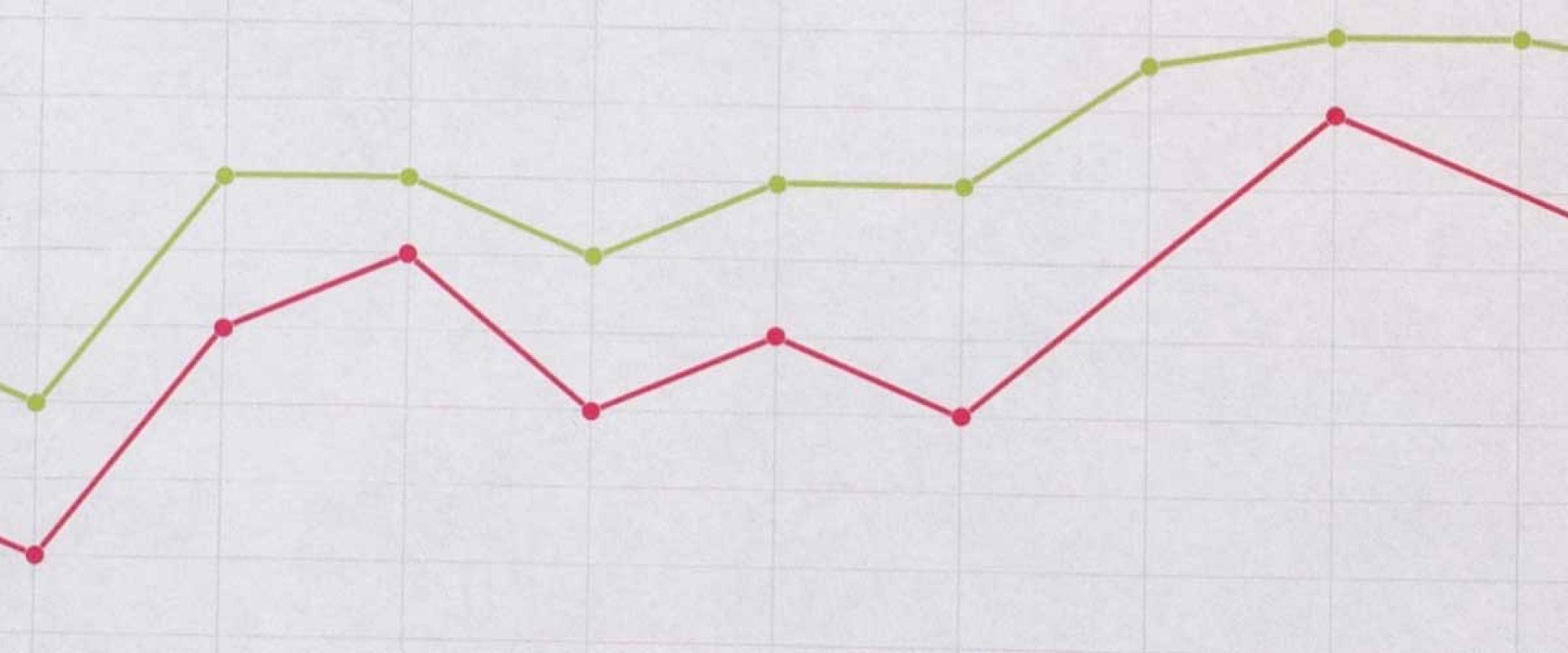

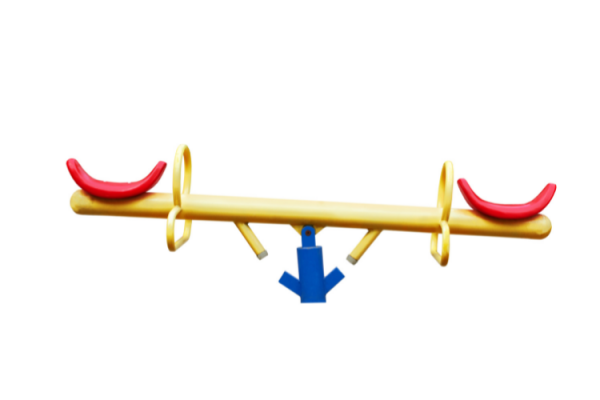

People forget - rental yields track interest rates.

A tenant always has a choice to buy but firstly has to come up with a deposit and then to pay interest on a mortgage.

If interest rates on mortgages rise, not only does a landlord need more rent to cover their own interest costs but the tenant finds the cost of a mortgage increasingly prohibitive, so is obliged to carry on renting.

The net effect is, over time and with a slight lag, rents are always higher than interest rates.

As a landlord, whilst rates go up, you can be confident that your rent will keep pace.

Share this article

k L E D