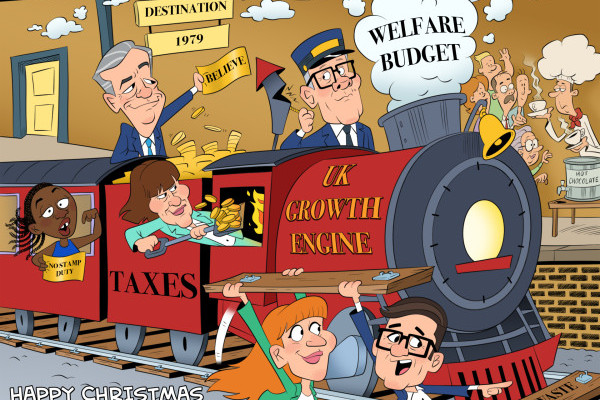

Tory Tw*ts & their Terrible Taxes

Monday 13th June 2022

Our Prime Minister is facing considerable headwinds. In his latest speech he seems to be suggesting people on housing benefit could buy a property using their housing benefit, paid by the taxpayer, to fund their mortgage payments. (https://www.gov.uk/government/speeches/prime-ministers-housing-speech-9-june-2022)

This is hot air. The whole reason why people are on housing benefit is because they cannot make ends meet on their own. No lender will consider them a good candidate for safe mortgage lending. Plus, where will they get their deposits?

Why on on earth should those hard-working people, not relying on the state and not themselves able to afford to buy a property, fund this through their taxes?

Better the Government drop this idea quickly and move on. They could pursue my social housing idea which is much more logical - See my 1st June article on the topic: http://www.stanleypropertylondon.co.uk/blog/wheres-the-get-up-and-gove

Moving on ourselves - it was fun watching the Tories recent (no) confidence vote in Boris Johnson.

If each MP had realised how many of their colleagues would vote against him and therefore how close they actually were to a majority, those wavering might also have voted similarly. We could have had a leadership contest on our hands.

A shame. Still, some good could come out of bad.

There is now considerable pressure on Boris to make tax cuts to ‘unify’ the party and he does allude, in the same speech, to his desire to see taxes lowered.

The OECD is forecasting we will have the slowest growth in the G20 in 2023, citing high inflation, rising interest rates and increasing taxes.

Generally, OECD predictions are not worth the paper they are written on, and on this occasion they ignore the fact that UK growth took off before other G20 countries so the others are catching up in 2023. However, they are right the UK badly needs to lower taxes to drive growth in the economy.

Rishi Sunak has fallen under the spell of the Treasury Mandarins and is increasing, rather than decreasing, the tax burden. This has to stop.

He and Boris can say they are ‘natural tax cutters’ as much as they like but they need to prove it now - not for the benefit of the Tory party but for the sake of the UK economy.

PB

Share this article

k L E D