Poor Productivity (& Property)

Monday 11th August 2025

I am always staggered when politicians and the press struggle to understand why productivity in the UK has stagnated since the turn of the Millennium.

‘The productivity puzzle’ term has been invented for those who don’t have the wit to understand its causes.

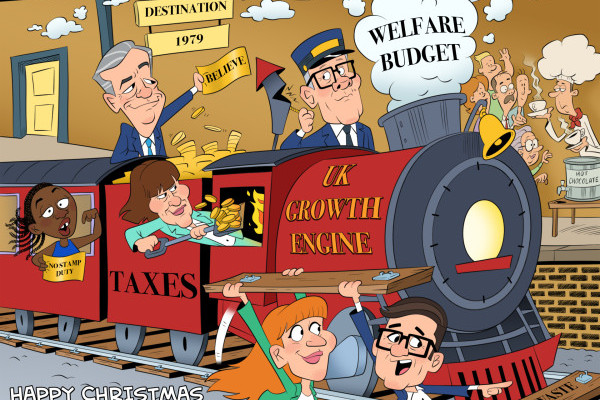

‘In work’ benefits existed in one form or another since the end of WWII but it was our old friend Gordon Brown who, when he was Chancellor of the Exchequer, turned the then-named Family Credit into Working Families Tax Credit but more importantly injected rocket fuel (taxpayers’ cash) into the welfare system.

The intention had been to ease the unemployed back into work. However, we now have a situation where about a quarter of the workforce is addicted to them.

28% of the £87.8billion the UK taxpayer spends on welfare is on the latest iteration called Universal Credit.

The reality is taxpayers subsidise employers who pay low wages to employees.

I have one client who has over 3,000 employees. Normally, a free-market fanatic, funnily enough he quite likes Universal Credit because it keeps his wage bill down.

Cheap labour costs have disincentivised businesses from investing in new technology to make efficiencies. Recent AI advances could help solve this problem but it’s not the only answer. We still need to deal with the core issue of the taxpayer artificially subsidising employers.

And for the taxpayer, it is particularly galling because about 30% of the tax take gets chewed up by the Civil Service in their collection and distribution process.

Productivity has been flatlining, time for a defibrillator.

OK Patrick if you know it all - what might give us the kiss of life?

First is for the public, press and politicians to recognise the point.

Then comes the trickiest bit - persuading the belligerent business-blocking Civil Service to help, rather than hinder.

Over the last 25 years, wages have been distorted by these subsidies, and the UK needs to return to wages led by the market. Which in practice, at this point in the cycle will mean higher wages.

In practical terms, we need to see three actions phased in - with determination.

1. Get rid of employee National Insurance for employers.

2. Limit the length of time in-work benefits are paid.

3. Make it easier for employers to hire and fire without penalty.

Employees will be empowered by being paid directly and properly for their skills and work, plus saved the humiliation and administrative nightmare of being forced to claim benefits whilst in work.

There are of course many other tax reductions/breaks which could be introduced into the business environment but let’s not dream too much.

And what has this to do with property? Nothing really.

I’m sorry if you feel tricked into reading this on the grounds of property. It is August and I needed to pontificate on this.

If you tell me to stick to the day job I’d understand.

I’d love to hear other people’s ideas on how we can transition away from in-work benefits, thereby increasing the nation’s productivity.

Until next time,

PB

Share this article

k L E D