The Year-end Equilibrium Question

Tuesday 10th December 2024

London is not Right - and I don’t just mean the politics.

Central London property prices are out of kilter. I will come to my particular question as to how we may reach equilibrium. But context first…

The PR departments of the large agents are spewing out the usual end of year guff about house prices rising next year. One or two are actually acknowledging values in London may drift a little in 2025 but they say, will rise again in the years beyond. Pure guesswork - based on what?

It has taken some time but some of the more inquisitive financial journalists are just starting to see through this, recognising Prime London property prices have gone sideways since the peak in 2014/15 and are sagging as I write. The prices, not the journalists - who thrive on negativity!

Taking inflation into account, values are down in real terms - plus they have performed particularly poorly compared to other asset classes.

The ONS figures for Kensington & Chelsea, just published on 20th November, show average housing prices in the Borough dropped 12% from Sept 23 – Sept 24.

Ouch!

Higher interest rates are key to these price drops.

However, in Prime London, it is also the politicians’ stupidly short-sighted policies which are pushing foreigners away.

Some ‘Non-Doms’ are staying and becoming residents of the UK for tax purposes but those who do not have kids in school or other strong ties, are upping sticks and leaving, or have already left.

Even more importantly, there is very little incentive for new wealthy foreigners to come to the UK to replace them.

We have not been a business-friendly country since the 2008/09 financial crash. The new Labour Govt. has just doubled down on that for the next 5 to10 years with their punitive taxes for companies and foreigners.

Since the 1980’s London property prices have been boosted by foreign investors who are now leaving and with few new buyers to replace them.

‘Indigenous’ UK buyers who have been pushed out of London in the last 40 years to find affordable housing cannot afford a Chelsea house - yet.

So, my question is - when will Central London prices reach a point at which UK buyers can afford them again?

The route to equilibrium

To my ‘out of kilter’ point:

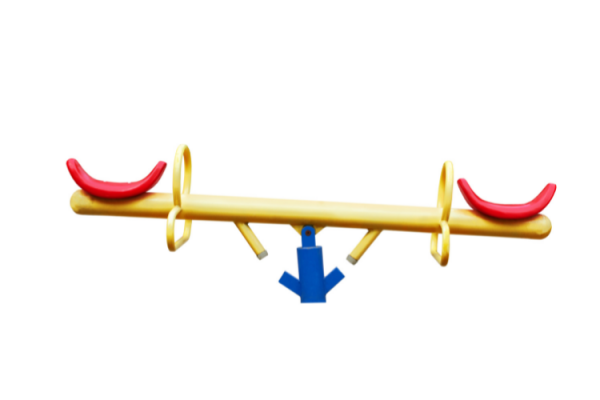

In my 35 years of mucking about in the London property market, the rent a tenant is prepared to pay tracks the interest rate for the equivalent mortgage borrowing rate - tending to settle about 1% point above.

There is always a balance between the merits of buying vs renting.

It is easier to pay a slightly higher rent rate (yield) than to come up with 25% of a property’s value in order to secure a mortgage. This is particularly the case in Central London with such high entry prices. A £600k starter flat requires at least £150k deposit. Not a sum commonly found down the back of the IKEA!

When rates move quickly, as they have recently, there is a drag for the rent to re-align with borrowing rates.

We have not reached that alignment point in Central London yet.

A typical gross rental ‘yield’ in Chelsea is currently around 4%. Just try getting a mortgage at that rate without a 50% + deposit.

Realistically, a 5% mortgage rate is more likely, and more if you are a buy-to-let landlord.

See my blog page for an illustration of the cost of buying a £1m flat in Chelsea vs renting the same flat.

Rents have risen dramatically because landlords are exiting the market. They may be peaking already as we hit the affordability rating for most London tenants.

Interest rates may come down further but that is happening slowly, and they will not (should not, in my view) return to the ultra-low levels of the post financial crash quantitative easing era.

So, the question is. What has to give, to get us back to the equilibrium where rents are slightly higher than borrowing rates?

Might it be the property prices?

We could all do with some Christmas cheer, so so see our Property Politics Christmas card on our website.

patrick@stanleypropertylondon.co.uk

Until next time….

PB

Share this article

k L E D